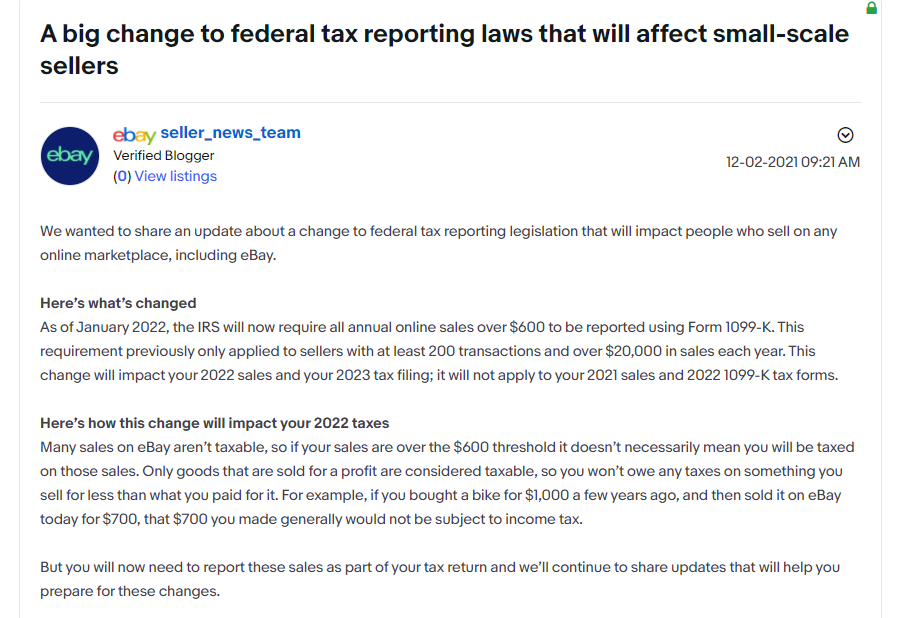

Recently,EBay has released a public announcement on its official news center stating that there has been a recent change in federal tax reporting legislation, which willAffects all online platforms (includingSellers sold on eBay.

According to the announcement, sinceStarting from January 2022, the US Internal Revenue Service will require the use of Form 1099-K to package all annual online sales exceeding $600. Previously, this requirement only applied to sellers who conducted at least 200 transactions per year and had sales exceeding $20000. EBay pointed out that,This timeChanges in federal tax reporting legislation will affect sellersSales revenue for 2022 and tax declaration for 2023,And it will no longer apply to sellers'2021 sales and 2022 1099-K tax form.

Regarding this,EBay stated that most sales activities on the platform are tax-free. So if the seller's sales exceed the threshold of $600, it does not necessarily mean that the seller must pay taxes. EBay indicates that,Only goods sold for profit are considered taxable, and sellers are not required to pay any taxes on goods sold below the actual paid price.For example, if a seller usedIf a bicycle is purchased for $1000 and recently sold on eBay for $700, the seller usually does not need to pay income tax for the $700 earned.

However, sellers now need to report these sales as part of their tax return, and this change will affectMillions of casual and small business sellers on eBay. This timeChanges in federal tax reporting legislation have causedEBay is less concerned by the community and is currently actively reporting issues to the US Congress.

EBay emphasizes that this new tax legislation will cause confusion, resulting in excessive reporting of non taxable income, privacy breaches, and other issues. EBay will emphasize to the US Congress the inappropriate impact this growth will have on small sellers on eBay and urge the US Congress to raise the reporting threshold.

Subsequently,EBay has released some unresolved issues that are currently being addressed by the US Congress:

1The tax table for small transactions is too complex

2For temporary sellers who are not prepared to process such tax reports

3Excluding the sale of second-hand goods, these goods are rarely taxable income as they are sold at prices lower than the original purchase price