Amazon Canada Station SellerPay attention to many things when selling, such asAmazon FBA feeIt may be higher in Canada; Exchange rate instability;CanadaThe tariff ofU.S.AHigh; Canada has federal sales tax (GST), etc.

IThe seller needs to pay attention to the exchange rate

Selling in Canada may result in higher FBA fees for sellers, depending on the product (especially smaller and lighter items). Ensure that when calculating Amazon FBA fees, do not assumeAmazon Canada StationThe same as the US station, the list prices of Canada shall be calculated separately.

Blue Ocean Yiguan has learned that,AmazonThe seller can raise or lower the price of the product on the Canadian station, however, the exchange rate is unstable.

For example, in 2011, the actual value of the Canadian dollar was more than $1, but in May 2020, $1 was equivalent to $0.70. The seller should pay close attention to the exchange rate. If it is not possible to pay attention once a month, it should at least pay attention once a quarter.

IICanada's tariffs are 25 to 50 times higher than those of the United States

According to Ecomcrow's data, Canada's tariffs tend to be higher thanU.S.A25 to 50 times higher. If the seller imports goods from China to the United States, and then exports them to Canada, then in fact, double tariffs are imposed on Canada and the United States. Technically, the seller can apply for the United States' tariffs back, but paperwork is very expensive.

The country of origin of the product will never change.For example, if the seller imports a small part from China to the United States, and then imports it to Canada, Canada still thinks that the small part is "made in China".

In addition, in Amazon, there is no cooperative operator to transport the seller's goods from the United States to Canada.The seller needs to arrange the logistics transportation from the United States to the warehouse of Amazon Canada.

The seller also needs Canada's Business Number to officially import products to Canada. But it's easy to apply.

When the seller delivers goods to Amazon Canada through FBA, he must ensure that all duties and taxes are paid before arriving at Amazon Canada. With UPS and FedEx FedEx, the seller can deliver goods through "DDP dutiable delivery", which basically transfers these costs to the seller and prevents Amazon from rejecting the seller's goods.

3、 Sales tax and GST/HST

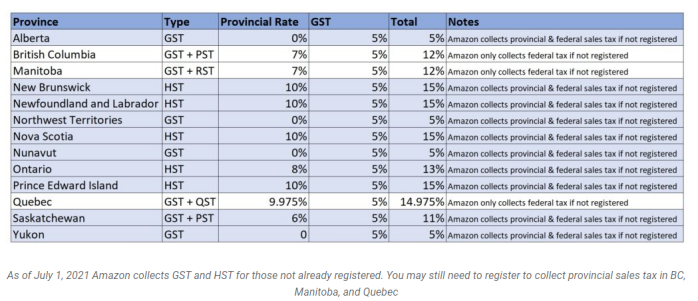

Canada has a federal sales tax called GST/HST, which is simpler than the United States. Each province has a GST/HST tax rate, and there are only 13 provinces/regions, which can be almost summarized in one table.

On July 1, 2021, Canada will launch MTC (market place tax collection platform tax) rules, which means that Amazon will be responsible for any unregisteredGST/HSTThe seller collects and pays GST/HST. However, sellers may still need to register for GST/HST to collect sales tax from BC (British Columbia), Manitoba (Manitoba) and Quebec (Quebec).

According to Blue Ocean Yiguan,Because Quebec, British Columbia, Manitoba and Saskatchewan have set their own provincial sales tax rules, while Amazon now levies sales tax on Saskatchewan, in fact, sellers only need to consider three provinces.

Although not registering does not seem to affect the seller's ability to import products into Canada, orAmazonSales, but the seller should charge these taxes. According to Ecomcrow, Quebec has an economic threshold of 30000 dollars, and sellers cannot exceed this threshold. Whether good or bad, many international sellers have never registered to collect provincial sales tax.

(Polly ZhangNew media of cross-border e-commerce - Blue Ocean Yiguan website domain news) connects with high-quality resources of cross-border e-commerce.Wal Mart, Coupang、Wayfair 、Mercado Libre and other platforms settled,Brand copywriting planning, network wide promotion, e-commerce training, incubation and other services, please contact us. No unauthorizedRewriting, reprinting, copying, clipping and editingIn whole or in part.