Recently, it was reported that Shenzhen Oni Electronics Co., Ltd.'s Growth Enterprise MarketIPO registration application approved.

Oni ElectronicsOn the evening of December 15th, the issuance announcement was disclosed, and the subscription will be made on December 17th. The stock code is "301189" and it will be listed on the Shenzhen Stock Exchange Growth Enterprise Board.

Sold within one year600 million yuan, selling well vs. suppliers? Its true identity is

As truly worthy of the nameAmazon cameras are selling wellas well asZebao's suppliers,Oni ElectronicsFinally, I took another step forward.

In 2005, desktop computers dominated the market, and it was during this period that Oni Electronics was officially established. Initially, Oni Electronics targeted the targetPC/TV external camera, while also balancing agency and distributionMouse, keyboardAnd other products. Oni Electronics boarded this express and proceeded smoothly.

untilIn 2010, the explosion of mobile internet greatly affected traditional PC internet, including Oni Electronics. Oni Electronics began to expand its business scope and found products in the same category as its core technology, such asBluetooth earphones, smart speakersWait, the migration cost is not high. In the following years, Oni Electronics continuously innovated and collaborated with third parties to achieve a sharp increase in revenue.

However, what truly brings Oni Electronics back to spring is the arrival of the epidemic. During the epidemic, people worked and studied from home, which causedThe demand for PC/TV cameras has surged, which is directly reflected in Oni Electronics' main business revenue in 2020. Data shows that from 2018 to 2019, the revenue of Oni Electronics PC/TV external cameras was around 50 million yuan, but in 2020, this figure surged to609 millionThe span is extremely large.

The sales data of this company, which started with cameras, is indeed impressive, but'Big seller' is not its only identity, but its other identity is' supplier '.In 2020, Oni Electronics supplied 100 million yuan to Zebao subsidiary Linyoutong and tens of millions of yuan to Qihoo 360.It is worth mentioning that the subsidiary of Neighbor Youtong includesUspicy, Anjou, TaoTronicsSome of the products are from Oni Electronics.

At present, the business models of Oni Electronics include“OEM factory”And“Private brand”There are two types, with ODM customization accounting for about three-quarters of revenue and private brand accounting for about one-quarter of revenue. In ODM customization mode, it is subdivided into“CustomizedODM”And“Menu styleODM”Among them, customized ODM customers have strong stickiness, which is beneficial for Oni Electronics to improve its technology and manufacturing capabilities.

epidemic situation'Assisting',PC/TV cameraBusiness focus

Whether it isBoth "customized ODM" and "menu based ODM" are ultimately the identities of suppliers. Under the supplier system, the company has lower bargaining power and less room for premium.

According to the financial report, fromFrom 2018 to 2020, the annual revenue of Oni Electronics increased from 295 million to 1.084 billion,The annual compound growth rate is92.96%,Almost doubling every year. Net profit from2.59 million yuan increased to 193 million yuan, an increase of over 70 times. In terms of profit margin, the net profit margin was less than 1% in 2018, 10% in 2019, and increased to 17.8% in 2020.

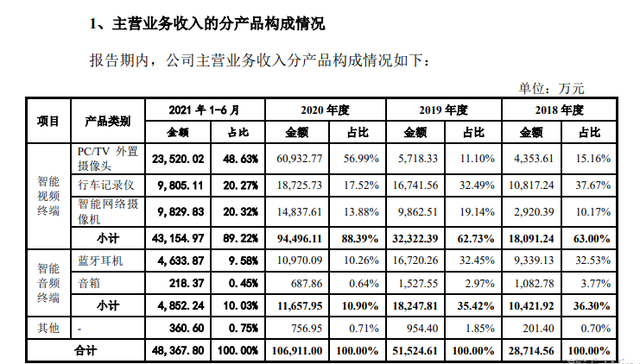

From the specific composition of revenue, the one that contributes the most to Oni Electronics' revenue is still mentioned aboveThe sales of PC/TV external camera business have surged from over 40 million to around 600 million, an increase of nearly 13 times,The share of overall revenue also increased from15.16% growth to 56.99%.

exceptIn addition to the PC/TV external camera business, revenue from other businesses has also increased, but the growth rate is far lower than that of the external camera business. Among them,The revenue growth of intelligent audio terminals is slow, and the revenue of speaker business has also experienced a significant decline.

In the online sales channels of Oni Electronics, the changes in sales trends are close to the overall business trends, and the growth of business share mainly depends onThe growth of PC/TV camera sales, with overseas PC/TV camera revenue accounting for over 60% of the overall online revenue.

PC/TV external cameras have leapt from being a business close to the "edge" before to becoming the main business driving revenue growth, and the epidemic has greatly aided Oni Electronics. However, this business that has experienced explosive growth due to the pandemic is also destined to not last for too long,stayIn the first half of 2021, the revenue share of PC/TV external cameras decreased to 48.63%.

From the purpose of this fundraising by Oni Electronics, the funds raised will mainly be used for the construction of intelligent video and audio production lines, the construction of intelligent audio and video product research and development centers, brand building, and marketing channel upgrading projects.

It can be seen that in the next step of planning, Oni Electronics will not only continue to expand its production line, but also continue to invest in research and development, brand building, and marketing channels. But in terms of the current situation, the research and development expenses of Oni Electronics have been decreasing,fromThe proportion of research and development expenses in 2018 was 8.01%, which has been reduced to 5% in the first half of this year.The next development plan of Oni Electronics still needs to be verified.

The proportion of raw material costs exceeds80%, Oni Electronics' risk intensifies

From its overseas sales data, in addition to offline sales, Oni Electronics' overseas online business mainly operates on Amazon and AliExpress, with Amazon being its main source of revenue. Among them,stayIn the first half of 2020, the sales revenue of Oni Electronics on Amazon was 39.4167 million yuan, accounting for 69.46%; The sales revenue on AliExpress is2.0504 million yuan, with sales accounting for 3.61%.

In addition, the business of Oni Electronics also faces several major risks due to various factors. In terms of cost, the rise in prices of bulk raw materials has a significant impact on the cost of enterprises, and Oni Electronics is no exception. stayIn the first half of 2020, Oni Electronics'The proportion of raw material costs in the main business has reached80.10%,If there are significant fluctuations in the market prices of major raw materials in the future, the company's profitability is likely to be affected.

In the first half of 2021, due to various impacts, the supply and demand of raw materials such as semiconductors and electronic components required by Oni Electronics were also tight, resulting in their costs being affected and lowering the gross profit margin of products such as cameras.

From a business perspective, the company's overseas business has covered multiple regions such as the United States and EuropeIn the first half of 2020,The proportion of overseas sales of the company to the current main business is as high as52.76%If there is turbulence and repeated outbreaks of the epidemic, it will affect the company's production and operation.

From the perspective of accounts receivable, the companyThe book value of accounts receivable in the first half of 2020 was 52.1340 million yuan, accounting for 12.13%. In this situation, if there is a significant change in the customer's financial situation, it is easy to cause bad debts and also affect the company's performance.

Overall, in this year's capitalist market, many companies have chosen to sprint after a surge in performanceIPOs are aimed at accelerating their own capitalization process, but the results often vary greatly. Some have successfully launched IPOs with high sales, resulting in a surge in stock price profits, while others have been forced to interrupt IPOs. For sellers, it is particularly important to grasp the current situation reasonably and choose the appropriate development path for their company and cross-border e-commerce business development.