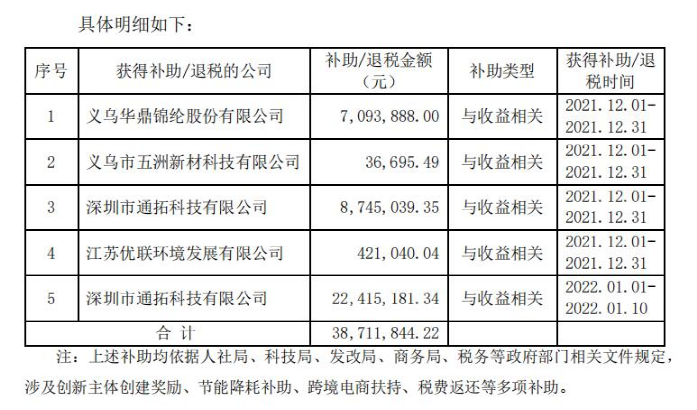

In less than a month and a half, Tongtuo Technology has received subsidies/tax rebates from the government, totaling more than31.16 million yuan.

About22415200 yuanIt's a tax refund, aboutRMB 8.745 millionIt is a government subsidy.

It is believed that many sellers are very envious. Just tax rebates and subsidies have an input of more than 30 million yuan. Many small and medium-sized sellers may not have the same annual revenue.

Whether it is a tax refund or a subsidy, it will greatly increase the net profit of the enterprise when it finally enters the book.

However, it is not necessary to envy big sellers too much, as long as the following conditions are met,Small and medium-sized sellers can also apply for tax refund subsidies:

You can apply for export tax refund by presenting the VAT invoice for import and export goods, the special payment form for consumption tax (split sheet), the declaration form for export goods and the contents related to the above vouchers.

● Cross border export e-commerce enterprises/companies

It is a general VAT taxpayer, and has gone through the qualification verification of export tax refund (exemption) with the local competent tax authority.

● Precautions

For export goods, relevant documents shall be obtained and the exchange shall be collected within the deadline for declaration.

SpecificThere are also several requirements for declarable goods:

● Export proceeds of declared goods have been written off.

Please find out how to operate through the official channels such as the tax bureau telephone and official website.

However, apply for tax refund and subsidy,It must be noted that:All processes must be legal and compliant! Judging from a series of recent events, the tax compliance issue has become a sharp blade hanging over cross-border e-commerce enterprises!

⑸ False VAT invoice, concealing income, and some enterprises are punished

Shenzhen Municipal Taxation Bureau recently released three punishment notices, two of which involve cross-border e-commerce industry!

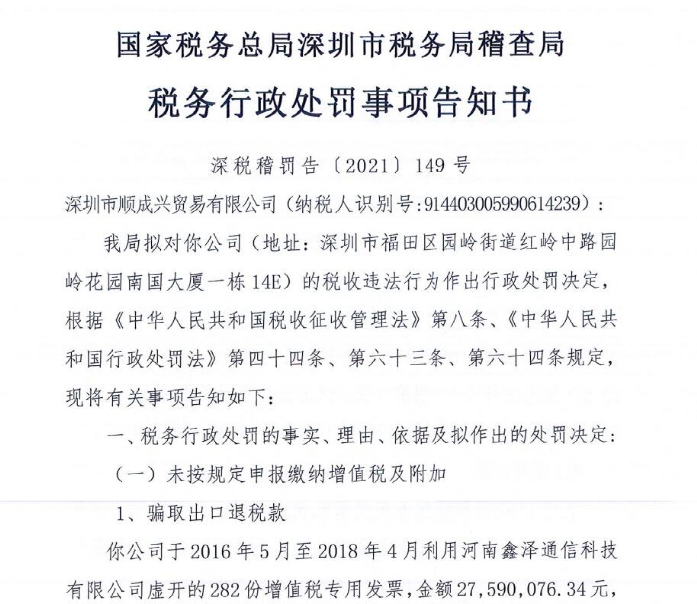

One is about the punishment of Shenzhen Shunchengxing Trade Co., Ltd. (hereinafter referred to as "Shunchengxing").

The company has the following conditions:

● Fraudulent export tax refund

From May 2016 to April 2018, Shunchengxing falsely issued 282 special VAT invoices using Henan Xinze Communication Technology Co., Ltd. (hereinafter referred to as "Xinze Communication"), involving an amount of about27,590,100 yuan,This is used to declare the amount of tax refund4690300 yuan.

● Obtaining export tax refund in violation of regulations

From April 2016 to June 2018, Shunchengxing falsely issued 916 special VAT invoices using Xinze Communication, involving an amount of about85.8107 million,And declare the tax refund agreement14587800 yuan.

Different from the "swindle" above, the goods involved in the VAT invoice of more than 80 million yuan should also be export goods, butThose that do not meet the tax refund standards are regarded as tax refundable products and falsely reported.

Therefore, it is characterized as obtaining export tax refund in violation of regulations, rather than defrauding export tax refund.

The above two false VAT invoices involved 1198 copies in total, involving more thanRMB 113 million.According to the law, the tax bureau verified the above goods according to domestic sales, and recovered about18.7028 million yuan.

However, Shun Chengxing's situation and punishment are not over yet!

By falsely issuing VAT invoices to defraud tax rebates and illegal tax rebates, Shunchengxing not only has problems in declaring tax rebates, but also has caused its existenceFailure to declare and pay corporate income tax as required!

According to the notice, because of the above circumstances, the tax bureau could not verify the cost of Shunchengxing Company, so the corporate income tax of Shunchengxing in 2016-2017According to domestic salesIt was verified that the corporate income tax was underpaid by about 633200 yuan in 2016 and about 242400 yuan in 2017.

Finally, the tax bureau will punish Shun Chengxing:

In addition to the recovery of the above agreement18.7028 million yuanIn addition, RMB 4.6903 million, which was judged as "tax fraud", was recovered, and the overdue fine was doubled. The total amount of the two items was about RMB 9.3806 million.

Meanwhile, for the part judged as "tax evasion", about 633200 yuan of corporate income tax will be recovered according to law, and the overdue fine will be doubled. The total amount of the two items is about 1.2664 million yuan.

Finally, multiple collection and punishment agreements29.3498 million yuan.

At the same time,It is suggested that the export tax refund department should stop handling its tax refund for three years from now on!

The recovery and fine of nearly 30 million yuan, and the failure to declare tax refund for three years, must be a profound lesson for Shun Chengxing.

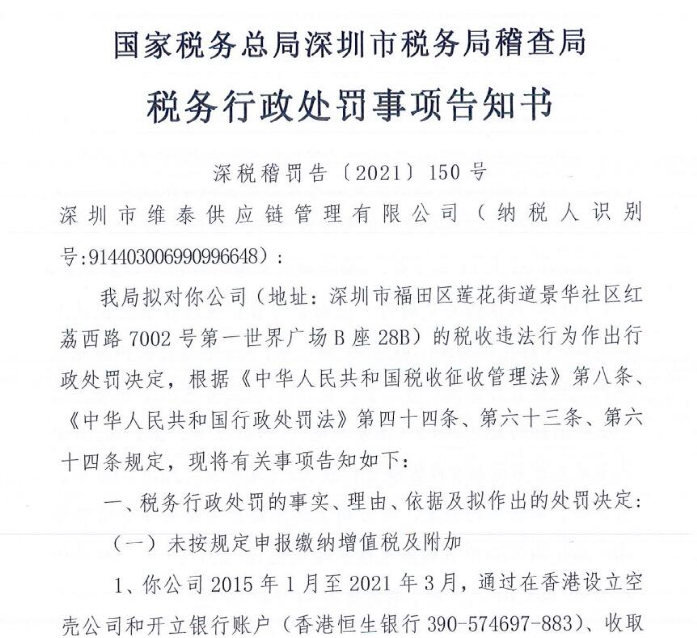

Another enterprise involved in tax evasion is Shenzhen Weitai Supply Chain Management Co., Ltd. (hereinafter referred to as "Shenzhen Weitai").

According to the Notice of Punishment of Shenzhen Municipal Taxation Bureau, Shenzhen Weitai has the following behaviors:

● Failing to pay VAT and surcharges as required

From January 2015 to March 2021, Shenzhen Weitai set up a shell company in Hong Kong and opened a bank account to collect business remittances paid from overseas.

In this way,Concealed income17.441 million yuan,As a result, about 492400 yuan of value-added tax, 39300 yuan of additional construction fees, 17700 yuan of education surcharges and 11800 yuan of local education surcharges were underpaid.

● Failure to withhold and remit individual income tax as required

【1】 From January 2014 to March 2021, Shenzhen WeitaiThrough personal accounts,The total amount of subsidies granted to employees is about 2.2275 million yuan; Through the Company's account,In the form of reimbursementThe subsidy was about 1.1074 million yuan.

The above behaviors resulted in the withholding of personal income tax of about 499500 yuan.

【2】 From January 2014 to March 2021, Shenzhen WeitaiThrough personal accounts,Issued to employeesOne time bonusAbout 1.157 million yuan; Issued through the company accountOne time bonusRMB 99000.

The above behaviors resulted in the withholding of personal income tax of about 54900 yuan.

【3】 From January 2014 to March 2021, Shenzhen Weitai paid labor remuneration to Wu Qiu, Zhang Wei and other company employees through the company account, and did not withhold and remit personal income tax of about 138500 yuan as required.

The total amount of personal income tax underpaid and withheld is about 692900 yuan. In addition, after being ordered by the tax bureau, Shenzhen Weitai has not made up the missing tax before the specified date.

● Failure to declare and pay corporate income tax as required

As a result of the above concealment of income and evasion of individual income tax, Shenzhen Weitai needs to pay about 2.6863 million yuan of corporate income tax.

For Shenzhen Weitai, the tax bureau plans to make a punishment decision:

The total amount of tax evasion was about 3.218 million yuan, and the overdue fine was doubled. The total amount of the two items was about 6.436 million yuan.

The corresponding unpaid individual income tax is about 692900 yuan, which is 1.5 times of the fine, about 1039300 yuan.

Total recovery and punishment7475200 yuan.

In the past two months, cross-border e-commerce enterprises have exposed many problems in tax compliance.

Previously, there was a case of "cross-border Weiya". A cross-border e-commerce enterprise in Hangzhou was fined 2.1 million yuan for tax evasion; Later, Patoson paid huge pre tax bonuses to senior executives in violation of regulations, which led to the accountability of the parent company Global E-shop and the parent company Cross Border Communication.

For cross-border e-commerce enterprises, tax compliance issues are extremely urgent. I hope that all the seller colleagues can pay attention to it. The fourth phase of Golden Tax has been launched. Any non compliant tax will eventually become a hidden danger that cannot be ignored. (Text/Blue Ocean Yiguan of cross-border e-commerce)