Your bank account ****** has successfully transferred 10000 yuan. After receiving the text message, an Amazon seller from North China finally breathed a sigh of relief.

Not long ago, this North China seller launched a sports brand on his Amazon platformD sells to capital and plans to invest in other product lines with cash. But this process is much more difficult than he imagined

Currently driven by capital, targeted at Amazon's third-party high-quality storesIn the "acquisition wave", there have been over 40 domestic and foreign companies, with over $10 billion in large consortia, targeting third-party sellers on the Amazon platform.According to industry analysts, the current wave of acquisitions is in a dividend period, but with changes in platform rules, capital requirements for Chinese projects are also increasing.

Perhaps you have also received capital throws in front of the screenThe "olive branch", but seemingly accessible business opportunities often contain some risks and challenges behind it. From the intervention of the capital to the completion of the acquisition, the entire process is complex and involves many professional fields, including early asset valuation, market bidding, price negotiation, mid-term due diligence, acquisition contract negotiation, and later asset transfer and account migration. If there is no comprehensive knowledge reserve and operational experience, it is easy to make mistakes in certain aspects, causing losses to the seller.

Capital acquisition of Amazon stores: three major pitfalls must be prevented

The acquisition business between sellers and capital is not always as smooth as reported in the market, and many sellers have stepped on these major pitfalls in the process of docking with capital:

Pit 1: Fierce high prices competing for projects

Without a detailed understanding of the seller's brand, the management provided a false check and quoted an inflated price toAfter winning the project with a quotation of 5-10 times the annual profit, the management can conduct exclusive due diligence on the seller.

Some investors even provide investment intent letters without even communicating with the seller. However, providing an investment intention letter does not represent the final acquisition intention and price of the investor. After the completion of due diligence, whether the project can be concluded at the intended price remains in the hands of the management. For sellers without trading experience, the entire process appears very passive.

Pit 2: Using delaying tactics during due diligence to disrupt operational rhythm

Some investors claim to be able toComplete due diligence within 45 days, but the result is that due diligence cannot be completed within 75 days, resulting in an unlimited extension of the transaction process and disrupting the seller's normal operational rhythm; Some well-known investors in China seem to have done a lot of market promotion and sufficient team layout, but it is understood that there are very few projects where the investors can successfully complete the transaction as scheduled.

The reason is:

1. Some investors use inflated quotes to grab multiple projects at the same time, and conduct due diligence on multiple projects at the same time, resulting in the internal team of the investors being distracted and unable to complete due diligence according to the promised time.

2. The core team responsible for the due diligence of the management and the final acquisition decision are all located overseas. Due to differences in time, language, culture, and other aspects, sellers have great difficulties in communicating with the management.

3. Some management attempts to drain the seller's patience and energy by extending the front line and avoiding communication, in preparation for their later price reduction.

4. Some due diligence teams of investors lack experience in cross-border operations related to Amazon, and lack professional expertise in the direction and focus of the investigation.

Pit 3: Pressing prices for various reasons before signing the acquisition agreement

According to the North China seller at the beginning of the article, theirStarting from 2018, brand D was launched, and the original plan was to invest the cash obtained from selling brand D into other brands. Among the many interested investors, he chose the highest bidder. After two months of due diligence, the investor maliciously lowered the transaction price by 40%, citing the increase in logistics costs during the due diligence period leading to a decrease in profits. As a result, the seller ultimately abandoned the transaction with the investor.

How does this type of management operate? Without the approval of the Investment Committee, the acquisition team of the investor sent a group of emails, offering a tempting high price to the seller and claiming to be able to quickly complete the transaction. At this point, the seller must not cooperate with other investors within the time specified in the letter of intent.

After surrounding the seller, it is difficult to find reasons to delay the due diligence or intentionally delay the progress of the investigation,After 2-3 months, the seller lowered the final transaction price for various reasons and even withdrew from the transaction, resulting in the seller's time and labor costs in the due diligence process being wasted.

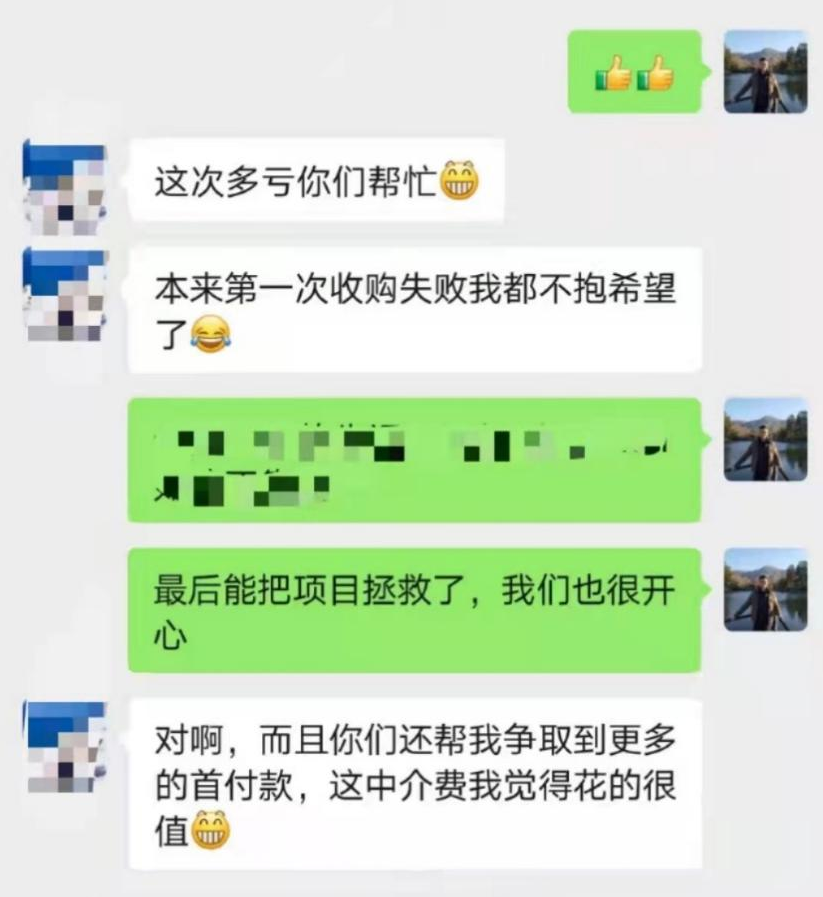

The seller collaborated with a merger and acquisition consulting companyFBAFlipper for remediation. As the earliest company engaged in Amazon e-commerce M&A consulting in China, FBAFlipper has contacted and collaborated with all mainstream investors in the market. Its team members have rich M&A experience, are familiar with the transaction processes of various investors, and have multiple bidding resources. Neo, the head of FBAFlipper, said, "Currently, we have cooperated with almost all mainstream investors in the market, and we have a clear understanding of which one is better or worse, whether it is a sincere purchase or an intentional prostitution“That North China seller is this yearContacted us in April and expressed interest in selling the project. However, the entire acquisition process has been quite tortuous, and the seller encountered many difficulties in the due diligence process. As the first investor unreasonably lowered the price by 40% towards completion, the seller was unable to accept the bargaining from the investor and decided to terminate the transaction with the investor. So, we immediately helped him connect with another investor that we were very familiar with, and ultimately helped him complete the acquisition at the originally expected price Neo said.

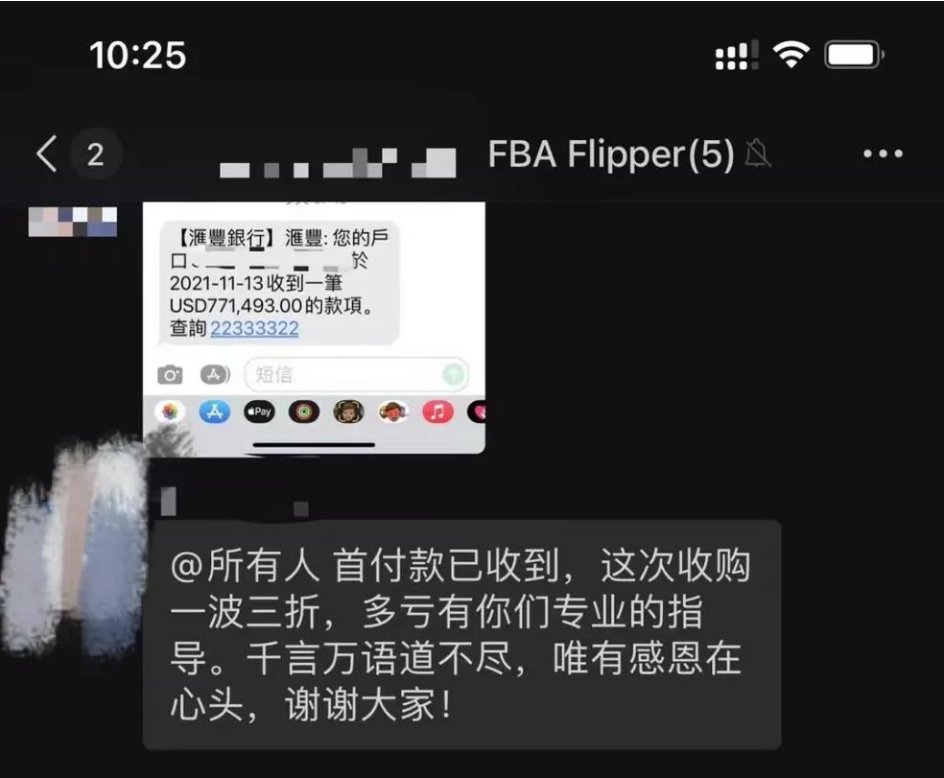

The project has come back to life, and the seller has also received the due transaction funds——The overall transaction amount is 2 million US dollars, equivalent to approximately 13 million RMB.

On September 10th, the seller's bank account received an 85% down payment of $1.7 million, which was transferred to two separate accounts of the seller. The remaining 15% will also be collected in six months.

(Screenshot of partial payment received by the seller after completing the transaction)

The seller stated that:It's really unimaginable that without the help of FBAFlipper, we would have been trapped by underpriced investors. The professionalism of the FBAFlipper team plays a significant role in the entire acquisition process, and with the existing energy and resources of our company, we cannot complete all aspects of the acquisition process alone. Without the help of a merger consulting company, we cannot sell our store at the ideal price

The total amount exceeds 100 million US dollars, which enables both capital and sellers to achieve a win-win situation!

Looking back, the relationship between this wave of capital and sellersThe "acquisition wave" is an important springboard for sellers to break existing development bottlenecks or increase cash flow distribution and diversify channels through capital; For capital, it is also a quick way to accelerate its penetration into the cross-border e-commerce industry.

How can we solve the problem that lies between the two in order to complement each other and achieve a win-win situation?

From the perspective of Amazon sellers, domestic sellers do not know the definition and measurement standards of high-quality Amazon brands from the management, and are unable to present their brand to the management in a perfect appearance.

From the perspective of foreign investors, as a foreign-funded enterprise entering China, acquiring Chinese e-commerce enterprises also faces cultural conflicts and difficulties in selecting truly high-quality Amazon brands.

As is well known, the operational style of Chinese Amazon sellers is completely different from that of foreign sellers. Therefore, many innovative operating methods that are seen by domestic sellers can actually increase account risk and become acquisition resistance for some investors, including some excellent Amazon brands in China.

The misunderstanding caused by cultural differences has led to some excellent brands missing out on opportunities to go overseas, which is reflected in the merger and acquisition consulting companyNeo, the person in charge of FBAFlipper, seems to be a very regrettable thing.

If a consulting company could build a communication bridge between the management and the seller, would such mistakes be greatly reduced?As an experienced consulting company in the industry,FBAFlipper's team includes many experienced individuals and overseas American members who are deeply familiar with cultural differences between China and the West, as well as Amazon industry rules. They can not only help sellers in various stages of the acquisition, bridge communication with the management, avoid potential risks and huge pitfalls that the management may encounter during the acquisition process, but also know how to present the domestic Amazon brand with a perfect appearance to the corresponding matching management.

(FBAFlipper team member)

According to statistics, as the earliest engaged in Amazon e-commerce M&A consulting in China, it was even earlier than most capital entering ChinaWith a 6-month professional team, FBAFlipper has completed over 80% of transactions in the Chinese market, totaling 17 transaction projects, including 4 projects exceeding $10 million, with a total transaction volume exceeding $100 million. The FBAFlipper team's professional services and ability to facilitate transactions have received unanimous praise from customers.

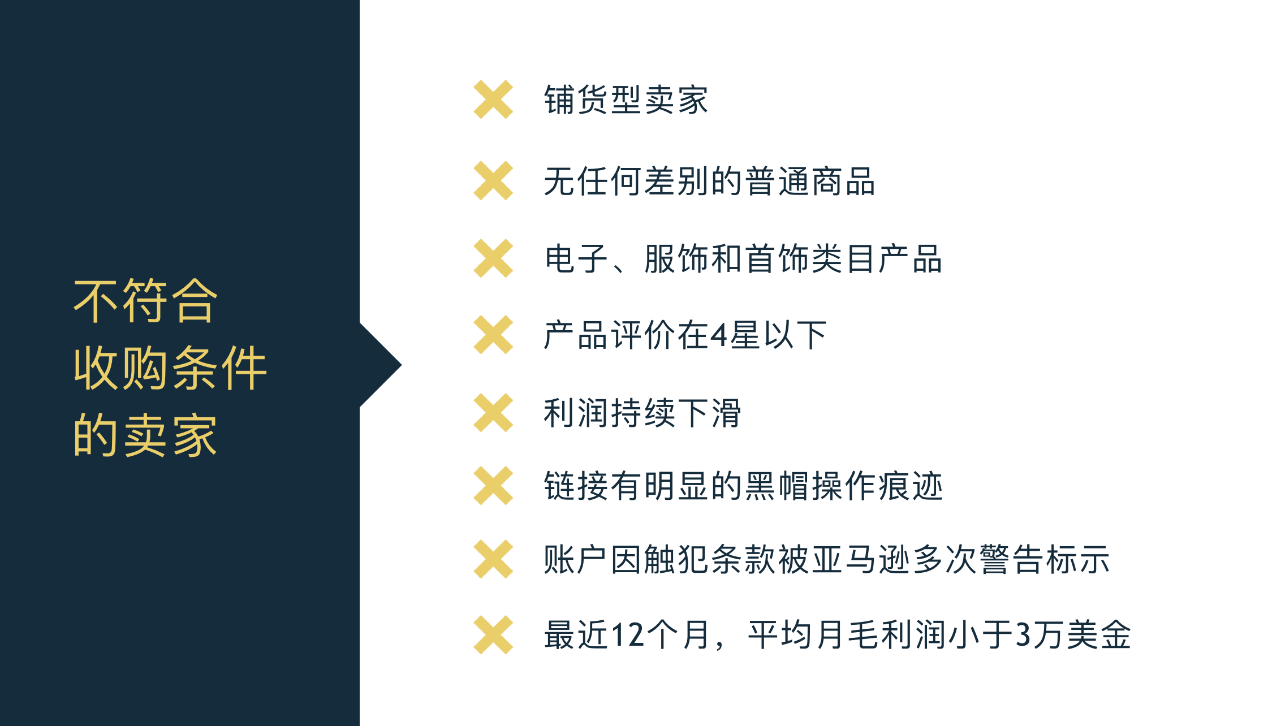

At the end of the article,FBAFlipper also wants to remind sellers that although mergers and acquisitions are a quick way to generate cash flow, they need to be vigilant and use professional consulting firms to identify the "white clients" in the market.

Amazon sellers who meet the acquisition criteria often need to have the following characteristics:

(FBAFlipper for image)

If you also want to gain a deeper understanding of the M&A industry and seek capital docking, you can add WeChat contactsFBAFlipper:Cheung9305 or rahile24Quickly obtain brand valuation.