Introduction:Recently, the term "three apps declared war on WeChat" appeared in the popular search of Baidu and Weibo respectively, causing heated discussion among users.

Recently, the term "three apps declare war on WeChat" appeared in Baidu andmicro-blogIn the popular search, it triggered a heated discussion among users. This is because it is reported that Zhang Yiming, the founder of today's headline and fast broadcastWang XinYunge AI under the leadership and Kuaru Technology on Luo Yonghao's platform will release new social products on the same day, which has broken the silence of the social industry for a long time. The social network market has a history of 20 years in China, andinternetSenior practitioners in the industry have chosen to conduct layout in this field at the same time, reflecting that China's social industry is facing new changes and development trends.

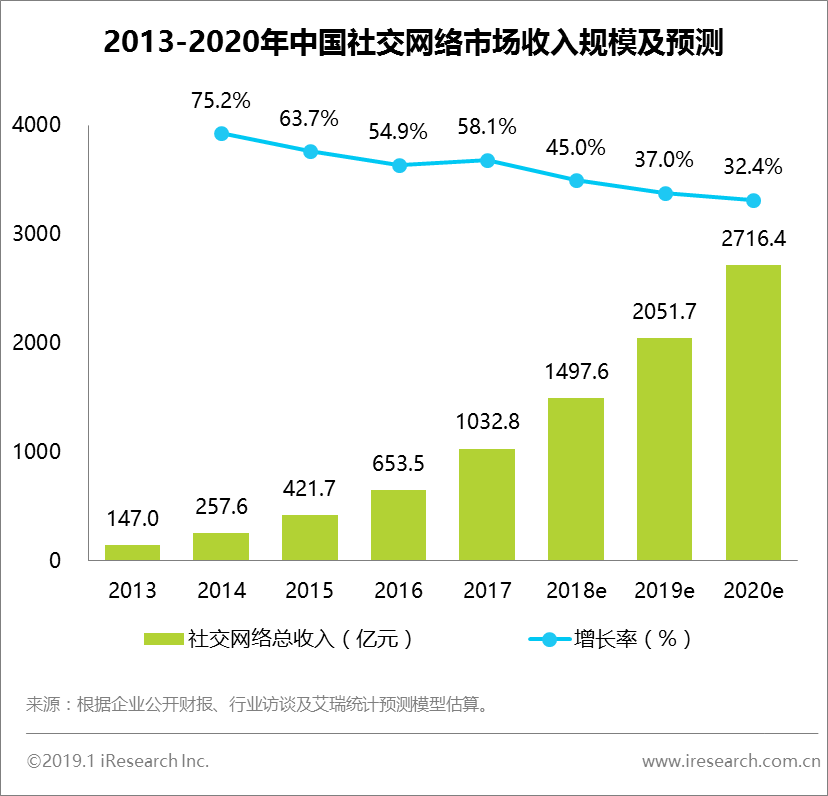

1、 In 2018, the scale of the social network market is close to 150 billion, and the industry has entered the stage of eliminating the turnips and reserving the turnips

In 2017, the scale of China's social network market exceeded 100 billion yuan, reaching 103.28 billion yuan, with a year-on-year growth of 58.1%. It is expected to maintain a relatively high growth rate in 2018, making the overall scale of the industry close to 150 billion yuan. This mainly comes from the social platformadvertisementThe good performance of revenue and the growth of user payment revenue. As the main profit model of social platforms, advertising has maintained a good growth momentum after decades of development. With the development of social platforms, information flow advertising, content marketing and other forms have evolved, so advertising revenue continues to rise. On the other hand, since the combination of new content forms such as live broadcast and short video with social networking, the diversified content forms have enabled users to have a richer interactive experience. In 2018, in addition to gift giving and member recharging, the social platform has improved users' willingness to pay through innovative business models such as content payment and integration with e-commerce, creating new revenue growth points, So that its overall market size will still maintain considerable growth potential in the future.

The market competition pattern has a strong "two eight" effect. The regional sinking and the emergence of new products are the main driving forces for the growth of user traffic

Since the end of last century, forums such as Maopu and Tianya Community have appeared. After 20 years of development, China's social networks have begun to show a relatively stable market competition pattern after entering the mobile social era. From the perspective of revenue share, at present, the top five enterprises in the social network industry account for more than 90% of the market share. This is mainly because advertisers prefer to place advertisements on the top social platforms with more concentrated user traffic, so the overall market shows a more obvious "two eight" effect.

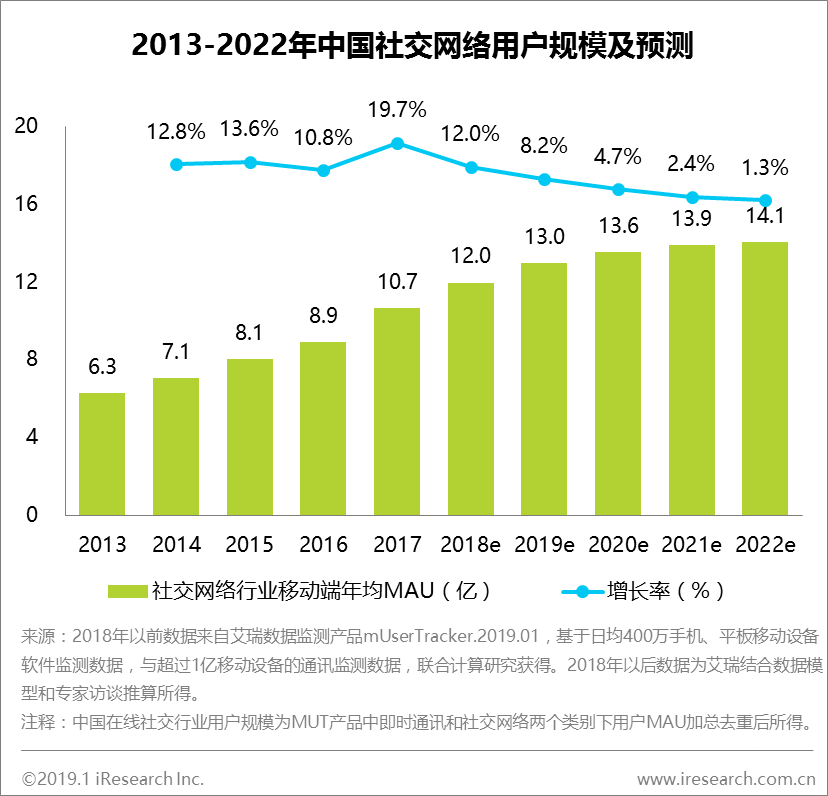

From the perspective of user traffic, in 2017, the user traffic of China's online social market, including social networks and instant messaging, has reached 1.07 billion, with a year-on-year growth of 19.7%, ushering in a small peak of growth compared with the past few years. The growth in 2017 mainly comes from two aspects. First, it comes from the trend of short video, live broadcast and other content platforms transforming into social products. Second, the regional sinking of head social products such as WeChat, QQ and microblog in the third and fourth tier cities has been effectively promoted in recent years. It is expected that the user growth rate will return to a relatively flat level in 2018, but the emergence of new products and the mining of younger generation user groups still drive the growth of user scale.

New entrants in the industry need to use strategies to explore the way to survive with competitive pressure

In the future, as the demographic dividend fades, the growth rate of social network users will become more moderate, and the overall traffic growth will gradually become saturated. According to the analysis of iResearch, under the dual background of mature competition pattern in the social network industry and slow growth of user traffic, although the market size still has growth potential, the survival space left by the market for new entrants is still limited, and the industry as a whole has entered the stage of taking the essence and removing the dross, so new entrants need to explore the way of survival with more innovative and differentiated strategies.

IIThe survival way of new comers

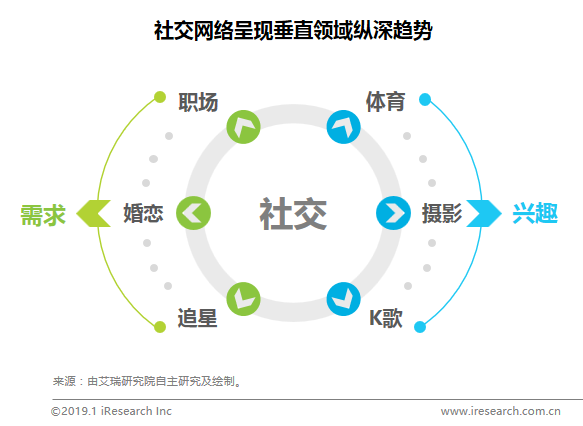

Content integration and innovation: vertically focus on user mining in vertical fields, and integrate more closely with pan entertainment content

Due to the prominent advantageous position of the giant enterprises, the current social industry tends to focus on the vertical field for further development. According todemandandinterestLocate and dig deeply into user groups in specific circles, and establish social circles to gather these users with common characteristics to meet the vertical social needs of users, so as to ensure the steady growth of user scale and the enhancement of user stickiness. For example, "Aidu", a social information platform to meet users' star chasing needs, and "Hupu", a community forum gathering sports fans.

On the other hand, with the development of social platforms, users' most basic needs for interpersonal and emotional communication have been basically met. On this basis, with the upgrading of spiritual consumption, users will prefer to meet the needs of leisure and entertainment through social experience. The diversified pan entertainment content just meets the needs of users at this level, so new entrants in the social industry will be more inclined to explore in the vertical field of pan entertainment.

Function integration and innovation: horizontally expand the functions and services of social platforms, and improve user stickiness

From the perspective of enterprises, when the scale of users expands to a certain extent, many Internet platforms begin to seek ways to enhance user stickiness by expanding social functions and building user communities. Social platforms also expect to improve users' social experience and efficiency by adding other functions, so as to further seize users' use time. This has led to the widespread emergence of innovative integration of social and other functions in many head Internet platforms and new products, and the demarcation line between social and other categories of applications has become increasingly blurred. Therefore, new entrants should seek integration and innovation in product design concepts and functional points, or try to provide more comprehensive and professional services for user groups with clear positioning in order to enhance user stickiness and product competitiveness while mining and accumulating user traffic in depth in vertical fields.

Typical fast growing products in the social industry meet the differentiation strategy, with significant crowd focus and functional characteristics

According to the data of iResearch mobile terminal data monitoring product mUserTracker, the overall user scale of China's social network industry showed a gentle growth trend in 2018, and the monthly compound growth rate of MAU from November 2017 to December 2018 was 0.9%. Among them, a number of vertical social products with more distinctive positioning and emphasis on specialization have shown outstanding performance. For example, the pulse of the business social networking platform, positioning the professionals, establishing a social network from the perspective of meeting the needs of users in terms of sales, recruitment, networking, etc., and at the same time increasing enterprise service functions such as knowledge payment, job search and recruitment horizontally, meet the characteristics of diversified product functions; The stranger social product Soul, which focuses on "soul matching", hopes to be different from the traditional social product dominated by face value. Users focus on the young people of the post-95 generation, and more emphasis on spiritual matching and communication, providing users with a differentiated social experience; And Chaoren social software "Poison" not only digs into Chaoren users, but also provides trendy commodity trading, authenticity identification and other functions on the basis of social interaction. On the whole, the three products all meet the needs of vertical users and provide differentiated services horizontally, thus achieving a relatively high growth rate of users.

It is no coincidence that three new apps entered the market at the same time. There is still a demand for new products in the social industry

Back to the topic of "three apps declared war on WeChat" mentioned at the beginning of this article, they are both new entrants in the social industry. The reason why they chose to enter the social market at the same time point is that there have been few new products in this incremental market recently, but there is still room for development and growth in the vertical field, and users are increasingly younger. There is still demand for new products, The industry as a whole lacks the existence of small giants other than the leading enterprises.

Focus on differentiation rather than "declare war on WeChat", and three products adopt different competitive strategies

By studying the characteristics of the three new products, it is not difficult to find that as new entrants in the industry, they did not choose to directly target the social giant with large users such as "WeChat" as the topic, but also chose the strategy of verticality and differentiation.

First of all, relying on the intelligent algorithm and short video content ecology of Today's Headlines, "multi flash" focuses on short video+social, hoping to give users a new short video chat experience. Short video content is burned after 72 hours of reading, realizing the integration and innovation strategy of social product functions, and combining with short video based pan entertainment content. The anonymous social product "Toilet MT" launched by Wang Xin, the founder of Fast Broadcast, forms a differentiated competitive strategy with other social products by meeting users' "anonymous social" needs. Finally, as a derivative of bullet messages, the social product "Chatbao" on Luo Yonghao's platform provides four functions: chat, news, good things and money collection. It integrates social+information and social+e-commerce functions, and attracts user traffic and stimulates user consumption through a reward mechanism.

Although the market has a living space, the risks of policy supervision and customer acquisition costs need to be paid attention to

In general, the three new social products have different characteristics and differentiated strategies, and rely on leading entrepreneurs in the Internet industry, so they all have the ability to attract a certain degree of user traffic. However, for the social industry, the emergence of new giants is not an overnight thing. Accumulating user traffic is a relatively long process, and there are multiple risks. On the one hand, the content produced and disseminated by social platforms is more vulnerable to the impact of policy regulation. The mechanism of burning short videos after reading, and the potential negative energy of anonymous social networking may become potential risk factors subject to policy regulation in the future. On the other hand, users are always the core competitiveness of social products. In the process of expanding and attracting user traffic, it needs to consume relatively high marketing and promotion costs. Especially for social products that emphasize popularity, such as "Chatshop", there is more risk of capital chain rupture.

Risks and opportunities coexist, and new entrants in the industry in the future should pay more attention to those "things that giants have not done“

Although there are many risks and competitions, social networking, as a necessary factor to establish an ecosystem, has always been a track valued by Internet entrepreneurs and investors in their layout. For users, social interaction is a rigid demand. In the era of mobile social communication, the position of industry giants such as WeChat and Weibo may be hard to shake, and the red sea competition in the market will continue in the next five years, but practitioners need to focus more on the areas that industry giants have not yet penetrated to seek growth space, such as the establishment of global social networks (this can already be seen in the embryonic form of game social networking), and social e-commerce in vertical fields.

In the far future, the social industry will change from two aspects:

First, changes in social forms have always been closely related to the development of science and technology. In the future, based on mature applications of 5G, streaming media, augmented reality (AR) and other technologies, social media will inevitably have further changes in carrier, content form, and interaction form;

Second, users at different social stages have shown significantly different use preferences and characteristics. With the change of new users, new social needs are bound to emerge.

For social newcomers, opportunities often exist in these changes. The so-called way of survival is not to "declare war on the giant", but to pay more attention to those "things that the giant did not do". The market has always reserved opportunities for ready and capable entrepreneurs. At the moment when the social industry is eager for innovation and diversified development, how to seize the opportunities and bring more surprises to users and practitioners is the survival way that entrepreneurs need to think and explore in the end.