Editor's note: This article is from WeChat official account"American Stock Research Agency (ID: meigushe)”, Author: Li Jun, 36 Krypton Sailing to Sea has been authorized to publish.

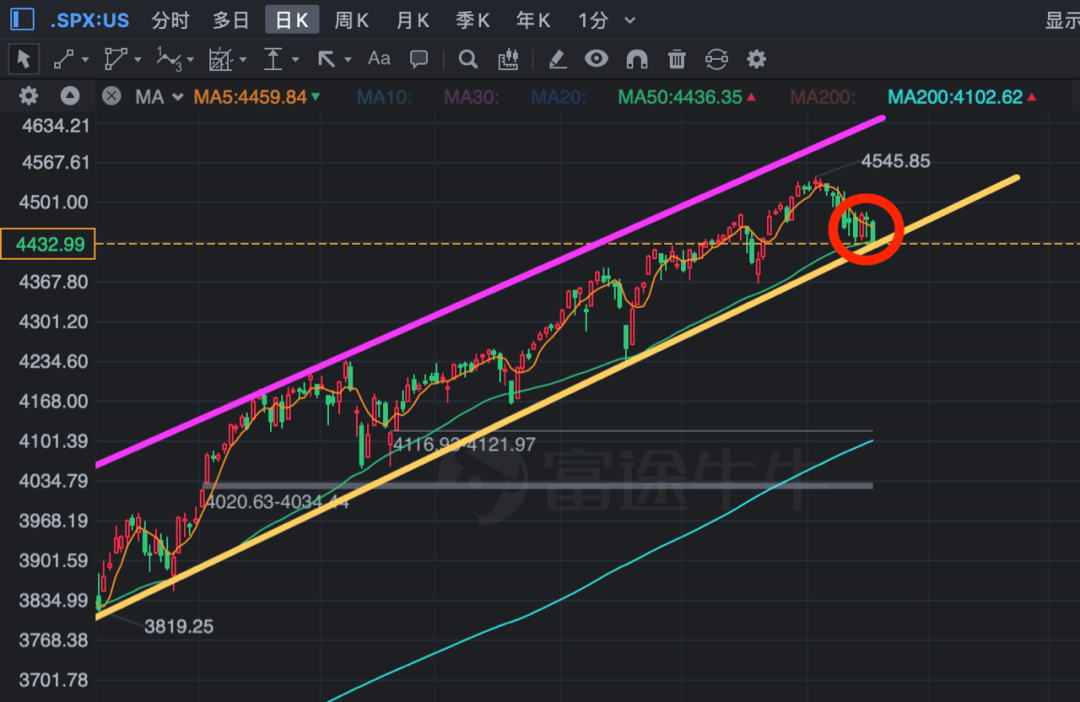

When it came time to review again, the market, as expected, stepped back on the box support, but after the four sorcery days last Friday, the market seemed to have undergone subtle changes.

Let's first analyze the trend of the next market. After the Dow hit a record high on August 16, it has adjusted its high for nearly a month, and closed down again on Friday, which directly broke the support line of the upward trend formed in the past six months. It seems that the top has also gone out of the very bearish head and shoulder shape.

Although the NASDAQ index did not fall below the important support, it seems to be in danger in the short term. If you look at the US stock market with short thinking, it has now formed a head and shoulders top, and has fallen below the neck line support. The downward trend of the short-term stock index has been established.

Although S&P did not fall below the box support, it closed below the 50 day moving average for the first time since June 18. For technical analysts, this is a signal that the short-term market is changing from bull to bear. It seems that the short-term market has gone out of a twilight star trend, and the current trend is not very optimistic. The market may be further adjusted.

Next week, the Federal Reserve's interest meeting will be held. The impact of the epidemic on the economy, when the Federal Reserve will reduce the scale of bond purchases, whether the interest rate increase cycle will be advanced, and whether Powell has new views on inflation will all together become the main investment logic in the medium - and long-term US stocks.

The current complex macro situation has attracted the attention of the Federal Reserve's interest rate meeting next week. In the context of high inflation pressure and time required for employment recovery, whether FOMC will clearly cut the schedule of asset purchase plans has become a major focus of this meeting.

We need to pay close attention to the new changes in the Federal Reserve's monetary policy. Because once there are new changes, this decline will become a medium-term adjustment, and the US stock market will probably face a significant retreat before the arrival of the financial reporting season on October 15.

In the medium and long term, there is another news worth paying attention to, that is, the tax reform plan for enterprises in the United States will be implemented soon, which is estimated to be the biggest "obstacle" to the future rise of American stocks. Biden is planning to raise the top corporate tax rate from 21% to 26.5%;Once the tax increase is really coming, it is estimated that the performance of companies in the S&P 500 index may decline by about 5%.

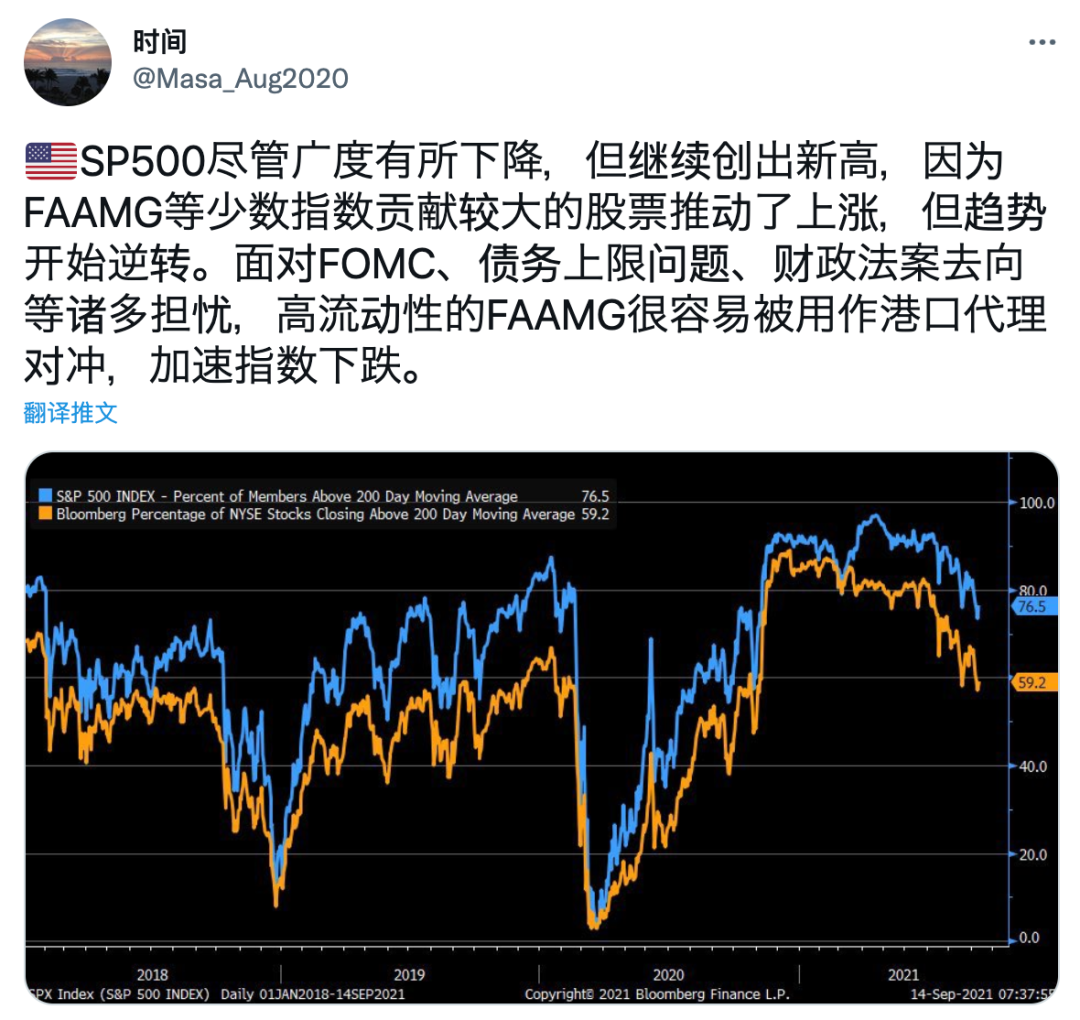

Mike Wilson, chief US equity strategist of Morgan Stanley, further reiterated the prediction that the S&P 500 index would have a 10% pullback. “ This may just be the beginning. Although the correction of the index has never exceeded 4% since March, since May 1, 56% of the constituent stocks in the index have returned more than 10%. The weakness of underperforming stocks will drag down high-quality stocks in the "rolling correction". Changes in the economic cycle always end with the correction of the index. It may be a week or a month later.”

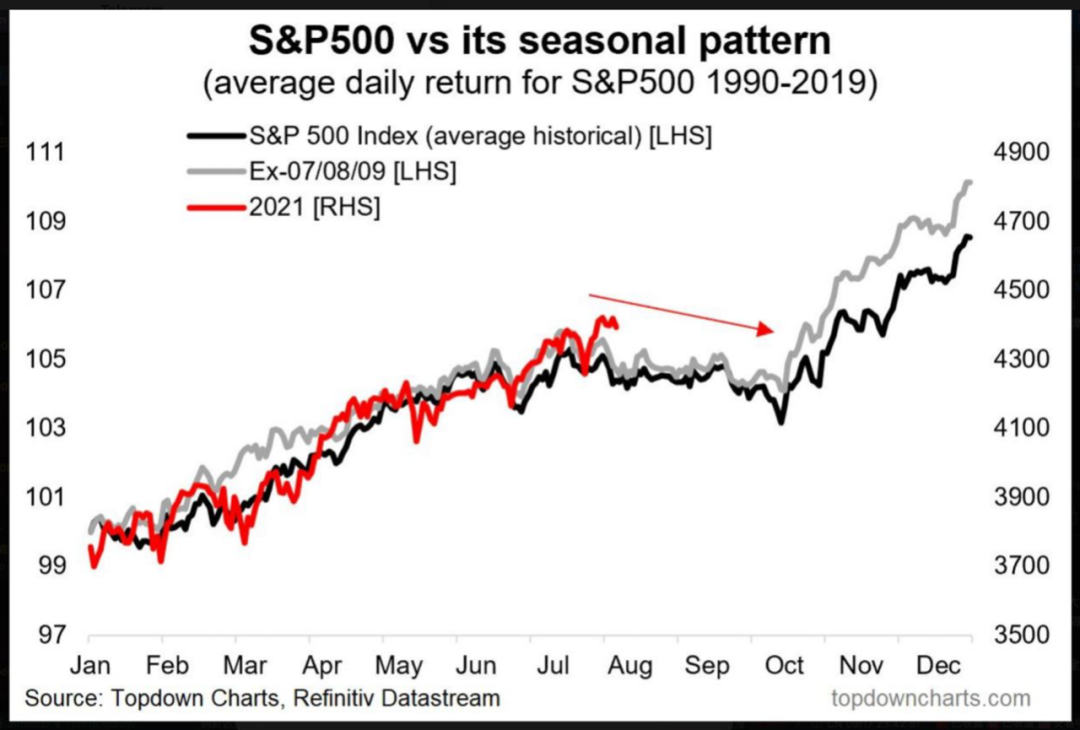

Historical statistics also indicate risks. September was the weakest month for US stocks in a year. Since 1945, the average decline of the S&P 500 index in September was 0.56%. It should be noted that the main decline segment of the index often occurs in the second half of the month, so the pressure on the index has not disappeared.

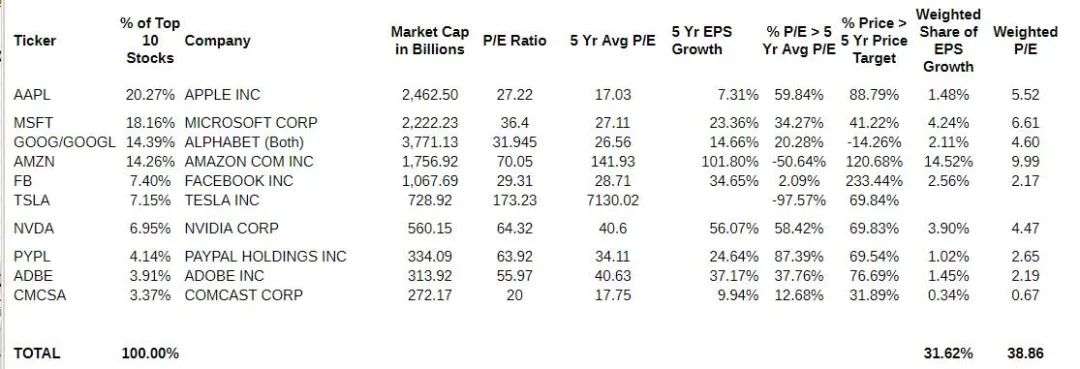

However, the decline of the stock index is not the reason to be bearish on American stocks. In fact, the rise of the stock index is largely due to the high weight of the seven giants of TFAANMG. When they rise at random, the basic stock index rises to the sky. Similarly, as long as they adjust, the stock index will fall more miserably, and Friday is precisely because the five giants of TFAANMG fell more. Tesla did not fall on Friday, but Amazon fell 0.74%, Nvidia fell 1.54%, Microsoft fell 1.75%, Apple fell 1.83%, Google fell 1.96%, and Facebook fell 2.24%.

Although the three major stock indexes fell on Friday, the profit making effect was not bad in fact. Many second-line growth stocks were soaring. The stock prices of some newly listed secondary new stocks had already risen to a high level. Healthcare, solar photovoltaic and some super dropped growth stocks had all gone through quite a good rise. From this perspective, funds did not flow out of the market, but a new plate rotation occurred.

There is obviously room for the three stock indexes to fall in the short term, which is not too surprising. According to past experience:S&P has 8 or more callbacks of about 5% and 3 or more callbacks of about 10% every year. However, since October last year, S&P has not seen a pullback of more than 5%, which itself is abnormal. Therefore, it is not unacceptable if this pullback turns into a medium-term adjustment.

The next interest rate increase by the Federal Reserve will be at least in 2023, so even if there are some changes on Taper at the Federal Reserve's interest rate meeting next week, it will only reduce the scale of bond purchases, which is not as loose as before, but it will continue to drain water. There is too much market capital to go to, and the stock market will have momentum to continue to rise.

When the Federal Reserve announced to cut QE in 2013, the valuation of US stocks was still at the low of the historical quantile. On the contrary, the process of cutting QE also triggered the seesaw effect of stocks and bonds. In the month after Bernanke gave the Taper signal on May 22, 2013, the S&P 500 rose sharply after a small adjustment. 2013 was even the best year for US stocks after the financial crisis. In other words, in 2013, under the expectation of QE reduction, financial institutions shifted funds from the US debt market to undervalued US stocks. This seesaw relationship also intensified the adjustment of US debt.

It can be seen that Taper is only a fluctuation factor for the stock market. However, due to the extremely high valuation of US stocks, this Taper still has some negative effects on US stocks. In 2013, the average 10-year Schiller cyclically adjusted P/E ratio of the S&P 500 index was only 23.2 times, and it has risen to 38.3 times in September 2021, which is the second highest level in history after the bursting of the Nasdaq foam in 2000.

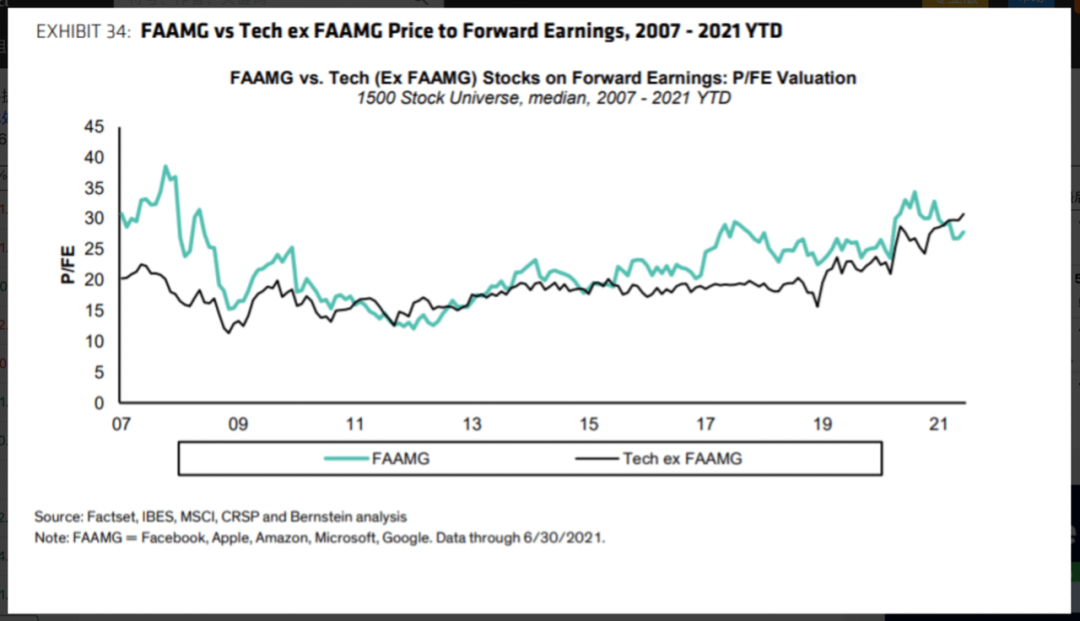

A few days ago, I saw a valuation comparison chart, saying that FAAMG has never been so cheap. Many people will be very surprised to hear that, after all, the stock prices of the five FAAMG giants have risen so much in the past two years, the P/E ratios of Apple and Microsoft have doubled, and the valuations have become cheaper, which is a bit counter common sense. This anti common sense fact is mainly due to the more exaggerated rise of some overestimated sectors.

FAAMG now has an average P/E ratio of more than 30 times. The valuation is not too exaggerated. The growth and cash flow of the giant are quite healthy. It is not too exaggerated to give a valuation higher than the historical average in the context of the current global water release. The chip plate with strong profitability has a P/E ratio of about 30, which is no more than the chip of A-share. Some second tier growth stock leaders with potential to develop into giants, such as TSLA of new energy, NVDA of chips and artificial intelligence, SE of emerging markets and e-commerce, SQ of financial technology, CRWD of cloud security track, all of which give an overvalued premium within an acceptable range.

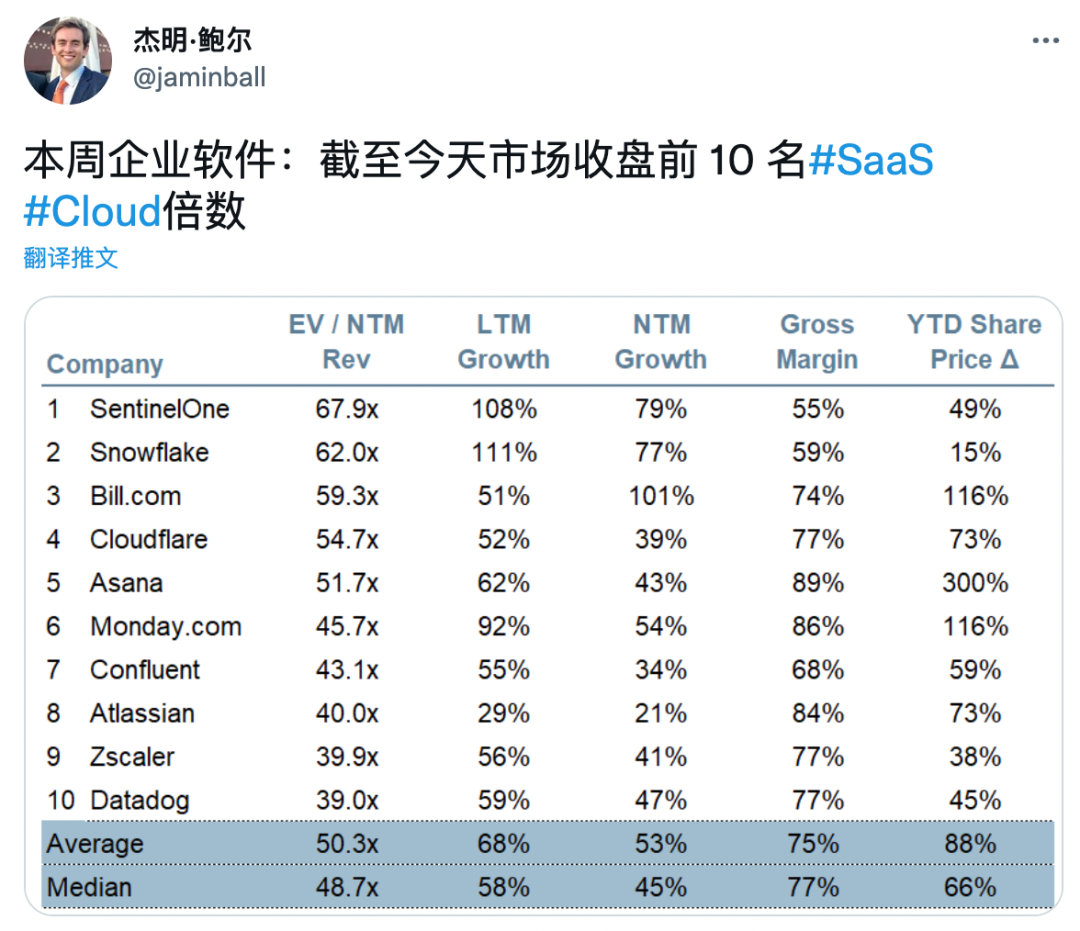

The key is some SaaS growth stocks, and the valuation is really a bit incomprehensible now. In fact, the most exaggerated increase in US stocks this year is in the SaaS sector. In the past few years, we can still use the 40 rule and the market sales rate (PS) to evaluate. At least we can understand it. SaaS companies with different growth rates are valued according to different market sales rates. The annual revenue * market sales rate is basically the approximate valuation range.

After the current US stock valuation entered the crazy stage, it began to use NTM (next two months Revenue Growth) to value SaaS. How to estimate the total revenue in the next 12 months is a metaphysic. For example, a company's quarterly revenue is 100 million US dollars, and its current revenue growth rate is 150%. The market sales ratio can be 30 times. The annual revenue is 400 million US dollars. According to the original valuation system, the reasonable valuation is almost 12 billion US dollars.

After using NTM for valuation, some institutions think that the next 12 revenues can reach $1 billion, and then multiplied by the current market sales rate of 30 times, the valuation can reach $30 billion. If we exaggerate, the agency thinks that the revenue in the next 12 months can reach $2 billion, and the valuation can reach $60 billion. For example, SNOW now has a quarterly revenue of 272 million dollars, and the agency can estimate the market value to 97 billion dollars. Another example is BILL, which has a quarterly revenue of 78 million dollars, and the agency can estimate the market value to 28 billion dollars.

This is a completely crazy performance of the current market. Take BILL for example. In fact, there is nothing commendable about the company's products. The growth rate in the new quarter is only 76%, and the expected growth rate next year is 100%. That is because of the acquisition of a company, Invoice2Go. The growth rate of BILL's core business is expected to be 58% next year. As for its expected growth of 100%, it is mainly due to its low base. If it buys a company at random, its revenue will increase by tens of millions of dollars, which will lead to growth. Now we are fully calculating the revenue of 400 million dollars this year and 600 million dollars next year. The current market sales rate has reached the sky high.

This year, the most exaggerated is not the SaaS sector, but the secondary IPO sector. The share price of any newly listed company has skyrocketed. DOCS, which conducts remote video conference for doctors, has a quarterly income of only $70 million, and its market value is now nearly $20 billion. The business model of UPST, a platform that helps finance and technology to make loans, is not sexy. The revenue of 200 million dollars in a quarter is less than, and the stock price has risen more than 10 times. Another SPT, which manages social media, has seen its revenue increase by 25% since last May, while its stock price has increased more than 10 times.

There were several companies just listed last week, and the specific performance and valuation will not be mentioned here. On the second day after the basic listing, a wave of mindless rising mode was launched. There is a craziness everywhere. The market is extremely optimistic about these growth stocks, but the question is, can the performance of these companies support the current valuation? This is a big question mark. When I saw the decline of RNG, ZM and ROKU after their growth slowed down, they were full of worries.

I remember that a long time ago, I had a clear view on the valuation of US stocks: "FAAMG has no foam, chip and second-line growth leader foam is not big, but the foam of new energy, SaaS and ARK dream stocks has never been seen before, and the foam is far more than the foam period of Scinet in 2000". Since February this year, many new energy and ARK dream stocks have been cut from their high positions. The foam has been punctured, but the SaaS sector is still hitting new highs. I believe it is a matter of time before the foam of this sector bursts.

I am not too worried about the growth prospects of the medium - and long-term US stocks. After all, FAAMG's valuation has not risen to the point of exaggeration, so this time it really turned into a medium-term adjustment, which must also be a very good opportunity to get on the bus. However, for the investment in the second half of the year, we need to pay attention to the new plate rotation, and the funds should be withdrawn from the highly valued SaaS plate to the low-lying plate.

Finally, I recommend two opportunities worth paying attention to:

Focus

Tuesday - September 21

1:00 p.m. - Workday (NASDAQ stock code: WDAY) will hold the 2021 Financial Analyst Day. Senior executives will give an online demonstration, and they will provide the latest information about the company's strategy, product innovation finance and customer motivation.

After the second quarter financial report was released, Workday raised the guidance, which made investors happy. This is noteworthy because it now shows that the company has regained its footing and accelerated its growth rate.

Workday expects revenues to exceed $5 billion by fiscal year 2022. If we assume that its revenue will increase by another 20% in the 2023 fiscal year, this will make the current forward sales of the stock about 10 times. This is a very cheap company in the SaaS track.

Specifically, the revenue in the second quarter increased by 19% year on year to 1.26 billion US dollars, slightly higher than the market consensus expectation of 1.24 billion US dollars. Subscription revenue increased by 20% year on year to $1.11 billion. For the third quarter, the company expects subscription revenue of $1.156 billion to $1.158 billion.

The company raised its annual subscription revenue forecast to $4.51 billion from $4.425 billion to $4.44 billion, while the market generally expected it to be $3.79 billion. Workday increased its adjusted operating margin guidance to 21% from 18% to 19% previously.

Brent Thill, an analyst at Jefferies, raised the company's target price for Workday from $300 to $320, and maintained its buy rating on the stock. The analyst updated his model to reflect the impact on labor investment, which will drive growth in fiscal year 2023. He expects that the profit margin of Workday will "start to rise" in fiscal year 2024 and beyond, as they are moving towards the company's long-term goal of 25%.

In terms of technology, after WDAY's financial report, it jumped short and went up in a large amount, and it has gone out of an obvious PEG. In the last ten trading days, it has gone out of the bullish triangle consolidation form at a high level. Next week should be the time to choose the direction. The financial report gives such a good guidance, and investors should have no bad news on the day, which is an obvious opportunity to do more.

Focus

Tuesday - September 21

A whole day - Invista (NASDAQ stock code: NVDA), Intel (NASDAQ stock code: INTC) and NXPI Semiconductor (NASDAQ stock code: NXPI) are some more interesting speakers of the two-day Evercore ISI Automotive Technology and Artificial Intelligence Forum (the theme is "New Paradigm of Mobile, Electrification and Computing 2021"). Analysts have always regarded the meeting as a potential stock price catalyst.

If the market falls next week, the chip sector should have an opportunity. On the one hand, this investor meeting will certainly have some prospects for chip prospects. On the other hand, Biden will meet with senior executives of chip companies at the White House, and I believe that he will also release some good news.

If INTC and NVDA fall on Monday, the closing of the day should be a very good layout opportunity. NXPI needs to be a little cautious. After all, there is a trend of falling below the triangle. This company is mainly due to the shortage of car chips. Many cars have stopped production, which has a little impact on the growth of its performance.

Fig. | Unsplash